Intro

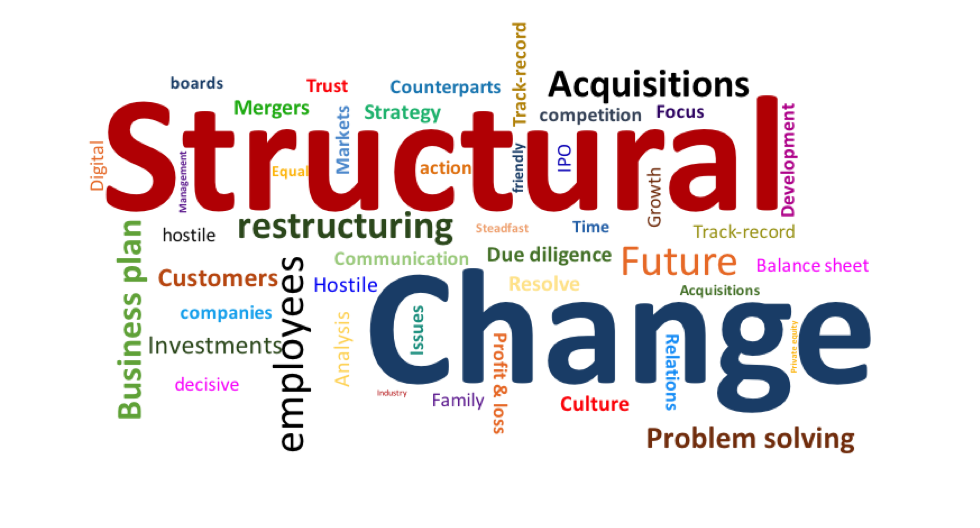

Rockfast believes change is a good thing, as long as it goes in the right direction. It is important to keep moving in an environment that changes quickly. If one stands still too long, the full potential will never be realised. It is magic to create a strategy, implement it and then experience the payoff. This also creates a proud and unified working group.

Team effort is important whether it s building a market presence, setting a strategy or generating quality leads. Rockfast listen to, and make sure it understands the Clients challenges, in order to identify the best solution.

Work

Mergers & acquisitions

All transactions are not successful. What are the most important success factors and how do you know which company is worth buying and when do you want to sell? What is the right time and what is the right price? Together we will find the best outcome.

Business strategy & development

When the trend changes, be proactive and not reactive – need to be one step ahead. Targeted action and innovative strategies are part of the success formula necessary to deal with customer demands and the competition. Technology and innovation increases in speed resulting in competitive advantages. Develop a tailored strategy with which to assert your company in a competitive environment.

Finance

Finance is how companies, organizations, etc. procure, allocate and use capital to carry out projects, such as developing a new product or starting in a new market. The components of the financial system are constantly evolving. As the financial system is constantly evolving by market players, there is also a constant debate about the extent to which authorities and regulators will regulate the activities in the financial market. By utilizing the dynamics of the financial system, opportunities for investors to manage risk are increased.

Project management/board member

The project management area focuses on planning and managing project work. The approach is to achieve efficiency. The work is focused on concrete solutions for breaking down, structuring, predicting and timing the situation in a project. Thereby giving concrete results.

About

Rockfast stands by the principles of steadfast, loyalty, honesty, reliability, and endurance.

Whatever the challenge! Rockfast was established by Petter Ski late 2016.

Rockfast stands by the principles of steadfast, loyalty, honesty, reliability, and endurance.

Whatever the challenge! Rockfast was established by Petter Ski late 2016.

Since the start-up, the following projects has been tasked:

- Chairman of the board for Phil’s Burger

- Advising the retail company Jula in different business development and M&A projects

- Advising ICA Banken on its fintech project

- Assisting Candelize in its business development

- Advising a group of high net worth individuals interesting in acquiring 3 companies with a combined total value of approx. SEK 400 million

The founder’s experience in short is as follows:

May 2013 – Jan 2016, Stockholm, Sweden

ICA Gruppen (ex Hakon Invest)– SVP Portfolio Companies

Responsible for:

- Coordination, preparing and evaluating as well as achieving added-value in the portfolio companies through corporate governance and business plans

- Coordinating and managing M&A projects through all stages of development:

- Divestment of Forma Group

- Divestment of Kjell & Company

- Divestment of ICA Norway

- Acquisition of Apotek Hjärtat

- Divestment of Cervera

- Acquisition of Hemtex through a public offering

Was a member of:

- Executive Management Committee of ICA Gruppen AB

- Chairman of the Hemtex board, a listed company on the OMX-Nasdaq

- Director of the boards of Kjell & Co, Cervera,

- Non-director of Forma and inkClub

Oct 2005 - May 2013, Stockholm, Sweden

Hakon Invest – SVP Investments & Portfolio Companies

Responsible for:

- Part of the core team evaluating and negotiating the Ahold-ICA transaction including the financing and capital structure of ICA such as the rights issue, MNT-program, preference share and RCF. This transaction resulted in the creation of ICA Gruppen AB

- Coordinating and managing the investment projects through all stages of development

- Coordination, preparing and evaluating as well as achieving added-value in the portfolio companies through corporate governance and business plans

Member of:

- The boards of Kjell & Co, Cervera, Hemma,

- Non-director of ICA, Forma and inkClub

- Executive Management Committee of Hakon Invest and ICA Handlarnas Förbund

Jan 2003 – June 2005, Stockholm, Sweden

ABG Sundal Collier – Partner

Heading-up M&A and ECM related projects:

- Liaison between ABGSC and client’s senior management

- Evaluated and formulated client’s strategies as well as transaction structures

- Setting the plan and participated in negotiations

Oct 2001-Feb 2003, Stockholm, Sweden

The Swedish Government, Ministry of Industry

Project leader:

- Assisted SwedCarrier, wholly-owned by the Ministry of Industry, in divesting an asset and company portfolio with a combined value of approx. USD 600 million

Sep 1997 – Sep 2001, New York, USA

Enskilda Securities Inc. - CEO

Head of Enskilda’s activites in North America:

- Responsible for (i) Equity Sales & Trading, (ii) M&A Advisory Services, (iii) ECM & Equity Research

- In charge of Enskilda’s alliance with the Blackstone Group in the US as well as Europe

1992 - Sep 1997, Stockholm, Sweden

Enskilda Securities - Director

Heading-up M&A and ECM related projects:

- Liaison between Enskilda and client’s senior management

- Evaluated and formulated client’s strategies as well as transaction structures

- Participated in negotiations

1990-1992, London, England

Enskilda Securities – Analyst

Member of M&A crossborder team:

- Financial evaluation, statistics, preparation of presentations, assisting in coordination transaction projects as well as pitches

1989-1990, Gothenburg, Sweden

Chalmers University of Technology – Research Assistant

Assistant in a research project conducted by the university:

- Researching the integration of manufacturing companies after a merger or acquisition for the Department of Industrial Organisation

Contact

info@rockfast.se

+46 70 291 40 58